The difference between Bitcoin and XRP

On October 31st 2008, Satoshi Nakamoto published a whitepaper on the cryptography mailing list at metzdowd.com describing a digital currency, titled “Bitcoin: A Peer-to-Peer Electronic Cash System”. On January 3rd 2009, the bitcoin network was created when Satoshi mined the starting block of the chain. And the rest is history.

Litecoin was the second cryptocurrency that was launched in October 2011, and after that came XRP. The underlying technology of XRP, XRP Ledger (XRPL), was the second major blockchain system and consensus mechanism that was different from Proof of Work that Bitcoin and Litecoin used.

The XRPL was launched in June 2012 by three bitcoin developers who saw the potential problems of bitcoin and Proof of Work and wanted to build something that would not use Proof of Work and mining to validate transactions. The goal was to create a better bitcoin, with a more sustainable and advanced consensus mechanism. The XRPL uses the Federated Byzantine Agreement (FBA) model as its consensus algorithm and it's called XRP Ledger Consensus Protocol.

Bitcoin's maximum supply is 21 million and XRP's maximum supply is 100 billion. The difference is that all XRP were created in the first day, all are in existence today and no more than the original 100 billion can be created. Until Bitcoin's supply reaches its maximum, they are created through the mining procedure, each block generates new bitcoins, which are distributed to the miners as rewards. That's how bitcoin's supply is increasing, while XRP works differently. There are no rewards, no more XRP can be minted and it is also deflationary, as every transaction cost is burned/destroyed, which slowly reduces its supply.

Proof of Work (PoW) consensus algorithm uses the mining procedure to validate transactions. Bitcoin miners act as the network’s transaction validators and verify all the transactions before including them in a block and then adding the latter to the blockchain. By verifying transactions and adding new blocks to the blockchain, miners earn block rewards. This is how new bitcoins are created and are distributed to miners as an incentive to validate transactions and secure the network.

On the other hand, the XRP Ledger Consensus Protocol relies on validator nodes, which are basically servers, to record and verify transactions without incentivizing any party. XRPL Validator nodes are nodes running as a validating server – meaning they are configured to participate in the consensus process for validating transactions and the governance of the network.

Validator nodes are different from miners, because they aren’t paid when they order and validate transactions. For consensus to be reached on the network, at least 80% of the validator nodes must agree. This means that there isn't a 51% attack on the XRP network like on Bitcoin network. Furthermore, on Bitcoin network whichever miner finds the blocks, they are unilaterally responsible for which transactions are approved and go into that block, while on the XRP network (XRP Ledger) the transactions and changes have to be approved by all the validator nodes (>80% for consensus) and not by a single node, like it happens with miners on Bitcoin. This means that the XRP network has a better, more robust and more decentralized structure than Bitcoin and Ethereum networks. But overall, both networks are decentralized, as they have no central authority and no single party can control their networks.

Unfortunately, there is a lot of misinformation in the crypto space, especially against XRP, and it's good and recommended for everyone to fact-check everything and do their own research. This article can help you clear up some of the XRP misconceptions: https://write.as/panos/why-xrp-is-the-most-misunderstood-cryptocurrency

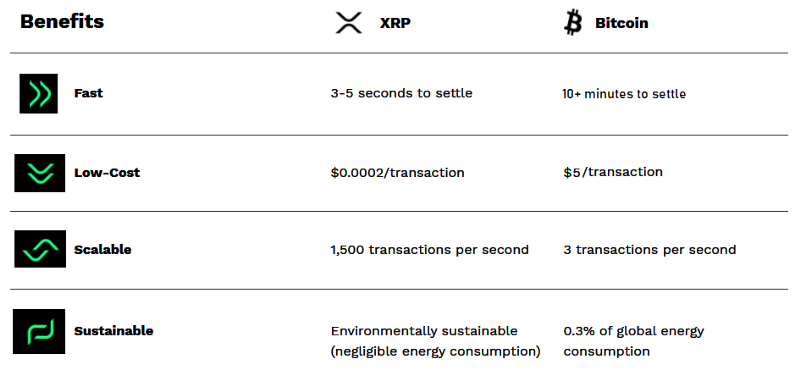

On average, one bitcoin block is mined every 10 minutes, but a transaction can take much longer, especially if there is a congestion on the network and high usage. The transaction cost can also vary from few dollars to tens of dollars. On the other hand, the XRP Ledger settles transactions in 3 to 5 seconds with a transaction cost of less than a penny (0.0001 XRP on average), and it can process 1500+ transactions per second.

Here you can see the main differences:

Another difference is that the XRPL has a built-in decentralized exchange (DEX), operating since 2012 and making it the first ever DEX. The XRPL has many great features and you can also issue tokens, IOUs, NFTs and use its smart contract features like escrow and checks.

Bitcoin was designed by Satoshi Nakamoto to be a P2P digital currency system. His/her/their vision was to use Bitcoin for P2P transactions and as an alternative payment system that had no central authority. But after some time, people started to realize that its consensus mechanism, Proof of Work, has many flaws, which lead to bitcoin becoming slow and expensive for what it was designed for. Furthermore, Proof of Work is not a sustainable system and consumes huge amounts of energy, which makes it non eco-friendly.

That's why the XRP creators built XRP and the XRP Ledger as a more advanced, scalable and sustainable system that would be closer to the real Satoshi's vision, regarding P2P transactions. The underlying technology of XRP uses a unique consensus algorithm, which makes it faster and cheaper to send transactions without having to rely on mining, thus making it more secure, eco-friendly and decentralized. In bitcoin, if someone gains over 51% of the mining power, then they can double spend and reverse transactions. Something that is not possible on the XRP Ledger, as it works differently, and over 80% of validators must agree for any change to occur. And there is no way to reverse transactions and double spend like you can do on bitcoin network. This is one of the most important problems of Bitcoin and Proof of Work that the XRP creators solved with the XRP Ledger Consensus Protocol.

Today, many people see Bitcoin as a store of value and a hedge against inflation and not as an efficient system for P2P transactions anymore. Either way, Bitcoin was the first in the market, it started this revolution and it's the reason we are all here today. It opened the way for this technology to show what it can do and allowed for more experiments to be done and better technologies and decentralized consensus mechanisms to be created. There is no reason for tribalism and maximalism. There are countless use cases, markets and problems to be solved by this transformative technology, and each cryptocurrency does its own thing. Like Bitcoin, XRP, Ethereum, all are focusing on different things and use cases. There will not be only one winner. We are in a new internet era.

In the end, blockchain is a revolutionary technology and it is transforming the world. Cryptocurrencies are the evolution of money and finance, and for the people who are here for the technology and the vision of decentralization, must let hatred and tribalism aside and support each other.

Some useful links to learn how Bitcoin and XRP operate:

Bitcoin: 1. https://bitcoin.org/bitcoin.pdf 2. https://en.bitcoin.it/wiki/Main_Page 3. https://bitcoin.org/en/how-it-works

XRP: 1. https://xrpl.org/intro-to-consensus.html 2. https://xrpl.org/xrp-ledger-overview.html 3. https://www.youtube.com/watch?v=fo8ZScrXFZE&feature=emb_title 4. https://www.youtube.com/watch?v=LK3nJ6HFGYY&t= 5. https://www.youtube.com/watch?v=f1aXZEVq_v8