For the past few months, there has been an increasing adoption and interest in cryptocurrencies and the industry as a whole. As we are moving to a new digital era and economy, crypto and blockchain will play a big role. In the midst of a bull run you can make money with almost every crypto, even scams. But what matters most is the long term success of a project and projects with good fundamentals. In the short term, the market is mainly driven by hype and speculation, but there are also many projects that are undervalued and don't have the attention they should have, for different reasons. It's time to have a look at some of them, starting from the ones with the lowest market cap.

1. Blockzero Labs (XIO) - https://blockzerolabs.io/

Market cap: $8 million

Supply: 25,179,182 / 100,000,000

Blockzero Labs is crypto’s first community-driven token studio and accelerator and it's basically a DAO. Blockzero is here to bring the next round of innovations and push DeFi one step further. Its mission is to build, launch, and scale the next generation of Web3 startups. The vision for Blockzero is to become the Y Combinator of the decentralized world.

They also build DeFi projects with the community, which is its strongest part and they are called Citizens. There are over 7,000 community members (Citizens) at the moment. One of the main benefits of becoming a Citizen is that you can participate in the Blockzero Mental Mining Program, a program that rewards Citizens for their prompt, consistent, and quality engagement across all social platforms. You can earn up to $1500 per month in XIO through this program. Citizens are rewarded in XIO tokens, the primary (ERC-20) token of Blockzero Labs. XIO is the native token of Blockzero that fuels the entire ecosystem. There are three utilities for the XIO token – Governance, Rewards and Staking. XIO holders earn all the tokens that Blockzero develops or join the Accelerator. Also soon, for the first time in the crypto history, XIO holders will be able to stake XIO and simultaneously earn multiple tokens at once, from all the projects that are in the Vortex (Blockzero DAO).

Finally, because Blockzero Labs is community-driven, all tokens developed by the token studio are 100% distributed directly to XIO holders. So, anyone who holds XIO tokens, will receive all future tokens that Blockzero Labs develops. Blockzero has also built Flashstake, the world's first flashstaking protocol and currently is developing AquaFi, a universal liquidity minig protocol.

In conclusion, this is a project/concept that every single crypto enthusiast should support and be excited about. This is one of the best concepts I have seen in the 5 years that I am in the crypto space. If I could describe Blockzero Labs with one phrase, I would say true innovation. Learn more about Blockzero here: https://blockzerolabs.io/blockzero-explained/

2. Flashstake (FLASH) - https://flashstake.io/

Market cap: $11 million

Supply: 15,713,234 / 22,965,227

You may have heard the term “money now is worth more than money later”. The time value of money means your fiat money today is worth more than your money tomorrow, because of inflation. Inflation increases prices over time and decreases your purchasing power. But what if that could change and you could be able to bring money from the future?

For the first time ever, this concept becomes a reality with Flashstake.io. Developed by Blockzero Labs, Flashstake is a permissionless protocol allowing everyone to stake FLASH tokens and earn instant upfront yield. It enables a new DeFi framework that wasn’t possible until now: Flashstaking. Instead of staking and earning small amounts of interest over long periods of time, Flashstake allows you to earn instant upfront yield on your crypto. $FLASH is the primary flashstaking token that gives the safest, fastest, and easiest transition for the protocol. If, for example, someone stakes for a year those FLASH tokens are locked up for a year. The result could be limited supply and price surge. There’s also incentivised token burning for early unstakes.

Overall, this is one of the most exciting and innovative projects I have seen. It’s the first of its kind, a revolutionary platform built by a visionary team. Flashstake solves the disincentives of locking capital for long periods of time by solidifying the market value of opportunity cost in the present. Read my article about Flashstake here: https://coil.com/p/Panosmek/Flashstake-The-Time-Travel-of-Money/_mfUzwgGL

3. Vulcan Forged (PYR) - http://vulcanforged.com/

Market cap: $31 million

Supply: 20,000,000/50,000,000

Vulcan Forged is already an established NFT game studio, marketplace and dApp incubator with 10 games, 12,000+ users and is in top 5 NFT marketplaces by volume (over $13 million). The Vulcan Forged ecosystem offers a full suite of tools for game and application development, with an NFT marketplace and arena to host gaming tournaments and other virtual events. Some of the popular games currently on Vulcan Forged include Berserk, Geocats, Rekt City and VulcanVerse. VulcanVerse, which is the flagship game of Vulcan Forged, is the first 3D MMORP to offer actual land parcel ownership.

Every decentralized ecosystem needs a token to empower it. Vulcan has $PYR, the native ERC-20 token for the Vulcan Forged ecosystem. In January 2021, Vulcan Forged and Matic announced a cross-chain partnership to launch their ecosystem-wide token PYR. With only 50 million total supply, this is probably the lowest supply token across all Virtual Worlds projects. PYR empowers a growing list of 10+ games and all elements of the Vulcan Forged ecosystem.

The token will be used in fee settlement, staking, DeFi game launchpads, play-to-earn benefits, gaming platform pools and discounted marketplace usage. PYR is a deflationary token, where on every PYR transaction, 10% will be sent to reward pools, and 5% used to buy-back and lock supply. PYR tokens can be used as a lock up token to stake and earn within the gaming ecosystem.

All in all, Vulcan Forged is on the verge of becoming the largest NFT and decentralized gaming ecosystem. The team is constantly delivering new updates and working towards revolutionizing the gaming industry. The fact that the PYR token has actual utility and many use cases in the whole ecosystem, makes it appeal to buy and hold, and the rich role will create an excellent, seamless environment for the games.

4. Plasma Finance (PPAY) - https://plasma.finance/

Market cap: $48 million

Supply: 154,432,135 / 1,000,000,000

Plasma Finance is a DeFi platform and dashboard that aggregates all of the most popular DeFi applications in one place. With the goal of simplifying the DeFi market for its users and eliminating some aspects regarding DeFi barriers to entry, Plasma Finance is working to become a cornerstone of the DeFi economy. The Plasma Finance platform acts as a bridge between DeFi markets and users and provides them a facility to use fiat on- and off-ramp services across the world. Users can send, exchange, request payments, deposit, and withdraw digital assets using their bank accounts or credit cards.

PlasmaPay (PPAY) is the native token of the Plasma Finance ecosystem. PPAY token holders can participate in the governance voting system, stake their tokens and earn rewards, and much more. The PPAY is a community utility token and unlocks the full potential of the Plasma ecosystem.

In conclusion, Plasma Finance is an innovative and powerful project. The platform is supported by many top protocols. It offers many attractive features to all user groups, ranging from a simple and easy-to-use dashboard for the new users to the advanced financial tools to control complex crypto portfolios for the experienced investor.

5. Zap Protocol (ZAP) - http://zap.org/

Market cap: $52 million

Supply: 247,619,465 / 520,000,000

Zap Protocol is the first decentralized data marketplace & oracle platform. it's a whole infrastructure where you can create tokens & oracles in a couple of minutes. Zap platform utilizes bonding curve mechanics, as the pricing mechanism for providers (Oracles/Services). Oracles use bonding curve to set price structure for each of your data feed, this bonding curve will not only serve as pricing model to encourage early users; ensure price stability( in the case of flat bonding curve); but also as a way users can speculate your data feeds. In simple words, it's like Ethereum, Chainlink and Uniswap combined, allowing for the tokenization of anything, including the oracles themselves, while offering decentralized, liquid markets.

All of these exciting features are facilitated by the ZAP token, which is used for monetizing feeds as well as access to the platform’s data. In order to launch or interact with a specific oracle on the decentralized Zap marketplace, you must first bond (lock) ZAP tokens.

Recently, the team launched a new updated UI with new features and with many partnerships in the pipeline, making it easier, not only for developers, but also for the average guy to use the platform. Read my article about Zap Protocol here: https://coil.com/p/Panosmek/ZAP-Revolutionizing-Oracles-and-Decentralized-Finance/mfI1Zz3w6

6. Safe Haven (SHA) - https://safehaven.io/

Market cap: $65 million

Supply: 4,700,000,000 / 8,500,000,000

Safe Haven is a decentralized B2B2C platform built on the VeChainThor blockchain and is building asset management and inheritance solutions on the blockchain. Safe Haven Tech has developed and patented the Share Distribution (SD) Protocol, which allows an initiator to encrypt and distribute digital asset shares between stakeholders, such as family members or business partners, through the use of smart contracts. With their solution, they are tackling a growing problem that every crypto investor will face at some point. Safe Haven encrypts data and assets until predetermined conditions are met such as death, illness or other, and then grants access to these funds.

Safe Haven is building various products and services integrated with its platform under the term “crypto asset management” and its flagship product is Inheriti Platform which is the first and only decentralized inheritance solution.

The SHA token is integral to the Safe Haven Platform and all of its products and services. The tokens fuel the whole ecosystem, acting as a service payment for the creation and execution of the 3 main smart contract types. SHA tokens also needs to be locked up, to join the TAN as a legal entity and to participate in the governance of the system. While tokens are locked, the circulating supply reduces increasing the value of SHA. The SHA token is integral to the Safe Haven Platform and all of its products and services.

All in all, this is a unique concept addressing real and urgent issues with the inheritance of digital assets. Safe Haven is solving a specific and important problem and it has a very good vision and strategy for the future, having already secured some good partnerships.

7. Meme (MEME) - https://dontbuymeme.com/

Market cap: $72 million

Supply: 25,631 / 28,000

MEME is a decentralized protocol for farming NFTs. But instead of farming for yield, DeFi users stake assets to earn limited edition NFTs from some of the top artists in Ethereum. The protocol allows staking, governance, fair distribution, and crypto collectibles.

The native token of the protocol is $MEME. Only 28,000 MEME tokens will ever exist (max supply), while 25,600 are already in circulation. The largest holders own less than 5% of the supply and there was a fair distribution to early community members via airdrop to about 1000 people. In simple words, the distribution and tokenomics are incredible and the vision of the team amazing. $MEME allows users to farm limited edition NFTs that could then be sold on the open market such as opensea.

Having some good partnerships with artists and platforms already, on March 23, MEME introduced its sister company — Nifty’s. Nifty’s is an NFT-focused social media platform that brings together publishers, brands, and creators with collectors, curators, and fans and it already has some big backers like Mark Cuban, Joseph Lubin, Tim Draper, Polychain, Liberty City Ventures, and NFT whale ‘0xb1’ among others. The MEME protocol will benefit from the partnership and new launch with additional resources to be channeled into product development. $MEME token holders will get a number of benefits. These include early beta access to Nifty’s products, exclusive access to community channels and special events and unique Nifty’s NFTs. MEME also announced its v2 launch which will go live on April 12. This version introduces a more streamlined NFT farming experience, improvements to user experience in artist discovery, and greater platform flexibility. So, this should give artists more control over their drops.

In conclusion, this is a project with a great story behind it. What was started for fun is now a unique concept that has big potential in the NFT industry that is just getting started.

8. LTO Network (LTO) - https://www.ltonetwork.com/

Market cap: $234 million

Supply: 280,246,746 / 401,931,245

LTO Network is a Dutch GDPR-compliant hybrid Blockchain for securing, verifying and exchanging business-critical information. It is a trustless blockchain that focuses on creating connections and collaborations between businesses. With this hybrid approach the LTO Network has become the first blockchain that is data privacy and GDPR compliant. It is the easiest to integrate Blockchain technology in the market and enables its customers to upgrade and interconnect their business systems seamlessly for a fraction of the costs of its competitors. This makes it one of the top projects based on Blockchain activity and price-to-earnings (P/R) ratio. Live Contracts were built to optimize business workflow. Combining private chains and a public Leased-Proof-of-Stake blockchain, the LTO Network enables General Data Protection Regulation (“GDPR”) compliant blockchain solutions. LTO Network is also developing a range of applications such as Proofi, FillTheDoc, and LetsFlow.

Its native token is deflationary as a part of the fee is burned and the rest go for rewards to the network participants. The main use case of the token is to enable the anchoring of data hashes on the public chain to ensure immutability and security, through the novel Leased Proof of Importance staking mechanism. The 3 main uses are: 1) It is used for Gas fees for data anchoring, token transfer, and other transaction types. 2) For Staking as part of the Leased-Proof-of-Stake model. 3) For Governance for on-chain voting.

Overall, this is a very solid project with real-world adoption, solving specific problems and with very good tokenomics. LTO Network's increasing adoption rate in B2B coupled with very interesting deflationary token economics and a low market cap and price gives it great upwards potential.

9. Quant (QNT) - https://www.quant.network/

Market cap: $498 million

Supply: 12,873,332 / 14,612,49

Quant is a technology provider, delivering enterprise-grade interoperability for the secure exchange of information and digital assets across any network, platform or protocol, at scale. Quant developed Overledger, the world's first blockchain operating system (OS) that not only inter-connects blockchains but also existing enterprise platforms, applications and networks to blockchain and facilitates the creation of internet scale multi-chain applications otherwise known as mApps. It provides enterprise and developers with what Quant calls “universal interoperability”. Quant's Overledger isn't a blockchain, but a blockchain Operating System that runs on top of blockchains to provide scalable Any-to-Any interoperability. It enables interoperability across many blockchains and legacy networks to be processed in parallel rather than being restricted to just 2 connected networks.

Quant Network currently has a business development pipeline of 300 clients consisting of financial institutions, central banks, government health services, and other enterprise-level organizations and established partnerships. They have already partnerd with big players like Oracle, Hyperledger, Nvidia, pay.uk, AWS and Binance.

The QNT token is regulated by the Swiss Financial Market Supervisory Authority (FINMA) as a utility token. The token is required for all the functions and the usage of the Quant Network and Overledger operating system. Access to the Overledger Operating System is only possible through the use of QNT.

In conclusion, Quant has the whole package. Great and professional team, with vision and strategy, solving a specific and very important problem and finally, incredible tokenomics.

10. Avalanche (AVAX) - https://www.avalabs.org/

Market cap: $3.9 billion

Supply: 128,052,492 / 377,752,194

Avalanche is an open-source platform for launching decentralized finance (DeFi) applications and enterprise blockchain deployments in one interoperable, highly scalable ecosystem. It is the first smart contracts platform that confirms transactions in under one second, supports the entirety of the Ethereum development toolkit, and enables millions of independent validators to participate as full block producers. Avalanche is capable of throughput orders of magnitude greater than existing blockchain networks (4,500+ transactions/second), and safety thresholds well-above the 51% standards of other networks. There are over 15 projects launched on the platform since September that Avalanche launched their mainnet.

The Avalanche (AVAX) token is the native token of the Avalanche platform and is used to secure the network through staking, transact peer-to-peer, pay for fees, and provide a basic unit of account between the multiple subnetworks created on the Avalanche platform. Transaction fees across all the blockchains in the Primary network, fees for creating and minting of assets, creation of blockchains and the creation of subnets are all paid in AVAX which are burned, reducing total supply. AVAX is one of very few projects where enterprise use still provides utility for the token.

In simple words, Avalanche is a platform of platforms and allows anyone to create their own tailor-made application specific blockchains, supporting multiple custom virtual machines such as EVM and WASM. Avalanche is creating the Internet of Finance, offering the best place to build DeFi applications and not only.

Bonus: XRP - https://xrpl.org/

Market cap: $43 billion

Supply: 45,907,836,568 / 100,000,000,000

Although I would say that XRP doesn't need an introduction, because there is no crypto investor that haven't heard about it, unfortunately there is so much misinformation about it and it is one of the most misunderstood crypto. And because of that many people do not know about its amazing capabilities and features, and along with its huge potential, it still makes it one of the most undervalued crypto projects, even if it's in the top 10. Not to mention the unfair lawsuit that the SEC filed against Ripple.

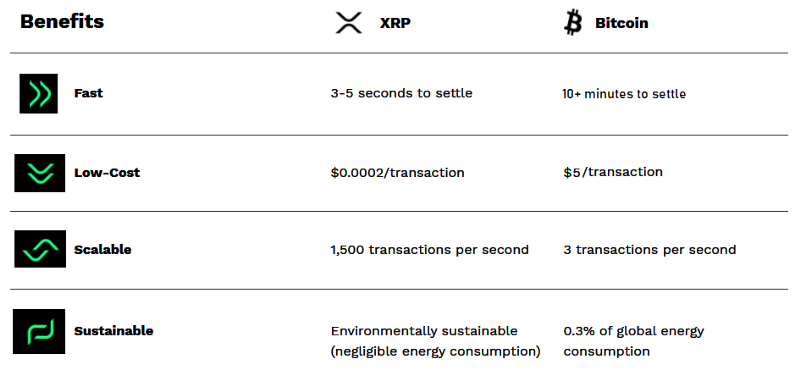

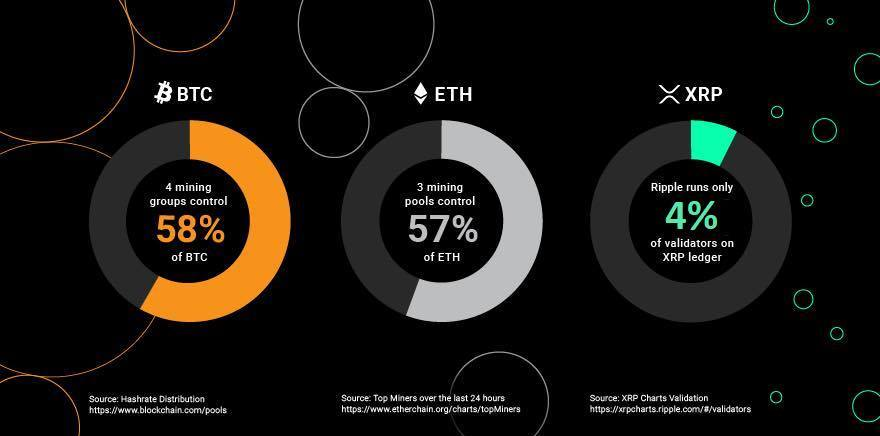

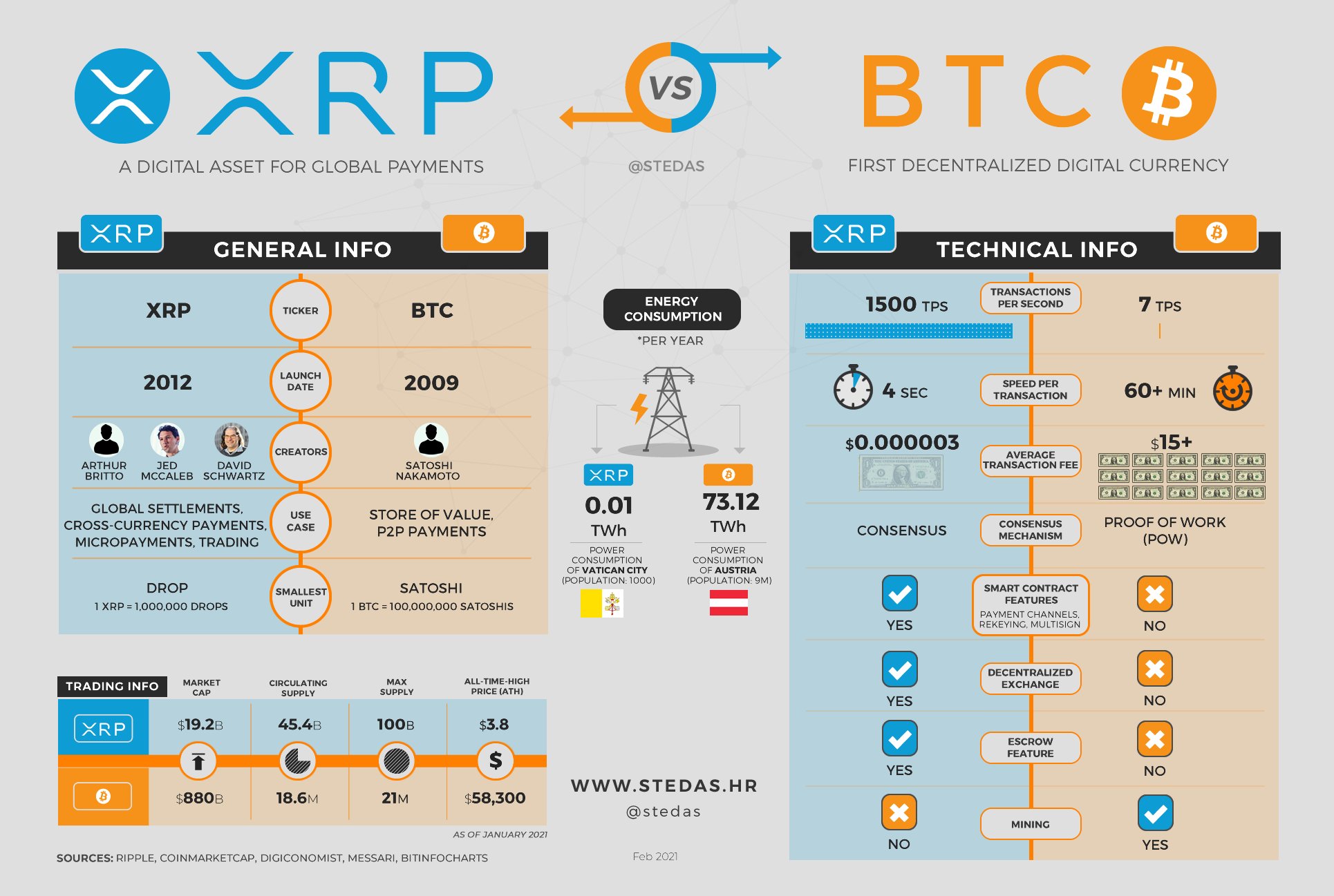

Created in 2012, XRP is a cryptocurrency that was mainly designed for payments. XRP is the native token of the XRP Ledger (XRPL), an open-source, permissionless and decentralized blockchain technology. XRP can settle transactions on the ledger in 3-5 seconds. It was built to be a better Bitcoin — faster, cheaper and greener than any other crypto asset. XRP is used by a wide range of individuals, developers, companies and institutions, who ought to develop innovative value-adding solutions in a decentralized manner. The XRPL uses a consensus protocol that relies on a majority of validators to record and verify transactions without incentivizing any one party. Today, there are over 150 validators that operate at locations across the globe and are run by a broad range of individuals, universities, institutions, exchanges and more. For consensus to be reached on the network, at least 80% of the validators must agree. Ripple controls less than 4% of all validators which gives them no power on the XRP Ledger. Anybody can run a validator and set it up in minutes.

The XRP Ledger has a built-in Decentralized Exchange (DEX) which is operating since 2012 and makes it the first ever DEX. Anyone can create their own tokens and IOUs on the XRPL and then trade them on the DEX. The XRPL also supports some smart contract functions like escrows, payments channels, checks and more.

Ripple, a company that was founded few months after the XRPL by some of its creators, has been a key member in the XRP ecosystem, but it's not the only one. Ripple is using XRP as a bridge currency between financial insitutions for faster and cheaper transactions, offering many benefits over the current and outdated banking system. Other than Ripple, there are many companies like Coil, Sologenic, XRPL Labs, Flare Networks that are utilizing XRP for different use cases like micropayments, gaming, DeFi and smart contracts. Finally, there are also many independent developers that are building their own projects on the XRPL.

Overall, XRP is the best cryptocurrency for payments, with one of the most secure, stable, scalable, eco-friendly and advanced blockchain systems. The adoption and usage is constanly increasing and it doesn't seem like it will stop anytime soon. With more and more people and companies learning about the uknown-to-most capabilities of XRP and the XRPL, XRP is one of the best crypto to buy and hold for the long term, as in terms of utility, technology and use cases, it's in the top.

If you want to see more crypto content, analyses/reviews and tutorials, check my patreon: https://www.patreon.com/panosmek

Disclaimer: This is not a financial or investment advice, only an analysis and my opinion on different crypto projects.