How enabling the Internet of Value can benefit the global economy and financial system

Over the past decade, we have witnessed the emergence of new revolutionary technologies such as blockchain technology and crypto assets. Blockchain can be described as a value-exchange protocol. In this regard, it is said that what the Internet did for the exchange of information, the blockchain will do for the exchange of value. Just as the Internet revolutionized the use and exchange of information, same with blockchain technology that is set to revolutionize the recording and exchange of value.

As we are making the transition to a digital economy, it is important to focus on how the new technologies can improve our daily lives and add value to our society and global economy. Connectivity, accessibility and interoperability are essential as the increase of globalization provides a need to transact and connect with each other no matter where we are. Businesses and individuals increasingly expect everything in their lives to move instantly. This is mainly because of smartphone and apps where nearly anything is attainable at the press of a button, but when it comes to money and financial service providers, they are often left with bad experiences.

The needs of individuals and businesses sending payments across borders have significantly evolved. They have traditionally been served by retail banks, which are not meeting their payment needs and are demanding real-time, low-cost and fully trackable payments on a global scale. But today’s inefficient system of moving money around the world means high costs for banks and payment providers.

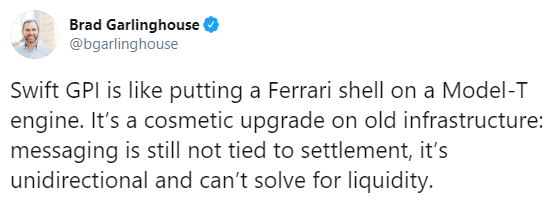

This is because an obsolete payments infrastructure, designed almost five decades ago, leads to expensive and slow transactions that can take days to settle with little certainty as to their ultimate success. This experience runs contrary to people’s expectations for an Internet of Value, where money moves as quickly and seamlessly as information. There are more than $5 trillion sitting idle all over the world in bank accounts just to make transactions around the world. This could change if financial institutions adopted blockchain technology and crypto assets, which would lead to less costs, increased speed, better liquidity management for financial institutions and better customer experience. Blockchain has the potential to change almost every industry out there. It can create a more efficient and prosperous world. Crypto-assets have also sparked a broader debate on payments innovation and on the roles of the private and public sectors in devising new ways to make payments more affordable, efficient and inclusive.

Consumerization of these solutions, and technologies including mobile wallets and blockchain, are leveling the playing field and allowing new entrants to compete with the handful of large banks that have historically dominated cross-border payments. Blockchain offers a cryptographically secure, end-to end payment flow with transaction immutability and consistency in information sharing.

The Internet of Value means moving and exchanging value like information is exchanged today in the Internet era. With the Internet of Value, a value transaction such as a foreign currency payment, can happen instantly, just as how people have been sharing messages, images and videos online for years. And it’s not just money. The Internet of Value can enable the exchange of any asset that is of value to someone, including stocks, votes, frequent flyer points, securities, intellectual property, music, scientific discoveries, and more. A truly interconnected world.

Until now, selling, buying or exchanging these assets has required an intermediary like a bank, credit card company and generally third-party services. Blockchain allows any type of asset to be transferred from one party directly to another, with no middleman. The transfer is validated, permanent, and completed instantly. Blockchain technology along with crypto assets are key elements enabling this process. By creating a shared ledger where people can own their own data, it also enables a shift in the locus of value within economy to the individual and networks. In a world of limited connectivity, limited transparency and limited peer-to-peer trust it was necessary to have third-party institutions to define, quantify and authenticate sources of value within society and economy. But in a world of pervasive peer-to-peer connectivity, transparency and trusted networks, value can be defined through a negotiation between peers within distributed networks.

On a macro-economic level, the Internet of Value could also help drive down the cost of goods and transactions as the liquidity would increase. In today’s country-specific systems, companies and banks must tie up large sums of money in local currencies for countries in which they do business in order to make transactions. An Internet of Value that eliminates the need for these accounts, suddenly frees up large sums of cash that can be more effectively put to use in the global economy. The potential use cases are plenty, from instant transactions to tokenization of assets, lending, smoother international trade, more robust digital agreements, and more.

1. Settlement of funds

Blockchain technology and crypto assets can simplify the entire process of payments and remittances, by removing unnecessary intermediaries. They can provide frictionless and instant payment and settlement solutions. Unlike traditional services and systems, a blockchain system doesn’t rely on a slow process of approving transactions, which usually goes through several mediators and requires a lot of manual work.

They have the potential to disrupt not only the world’s currency market, but also the banking industry as a whole by cutting out the unnecessary intermediaries and replacing them with a trustless, borderless, and transparent system that is easy to access by anyone. The use of crypto assets as a bridge for cross-currency transactions can eliminate the need of banks and payment providers to hold nostro – vostro accounts and pre-fund liquidity with foreign currencies. This means that the trillions of dollars trapped in multiple currencies could be used more productively to benefit the global economy. With a crypto asset as a bridge, banks only have to hold their domestic currency which minimizes the number of intermediaries involved and their markup on spreads which can save money, time and enable instant settlement with real transfer of value.

2. Asset tokenization

Buying and selling securities and other assets, such as stocks, bonds, commodities and derivatives requires a complex, coordinated effort between banks, brokers, clearing houses, and exchanges. This process not only has to be efficient, but it also needs to be accurate and added complexity directly corresponds with increased time and cost.

Blockchain technology simplifies this process by providing a technological base layer that enables the easy tokenization of all different types of assets. Since most financial assets are bought and sold digitally through online brokers, tokenizing them on the blockchain is a convenient solution for all involved.

Some innovative blockchain companies are investigating tokenizing real-world assets, such as real estate, commodities and art. This would make transferring ownership of assets that hold real-world value a cheap, fast and convenient process. It would also open up new avenues for investors with limited capital by enabling them to buy fractional ownership of expensive assets or investment products that might have been unavailable to them previously.

3. Lending

Banks and other lending firms have monopolized the lending sector, allowing them to offer loans at relatively high interest rates, and restrict access to capital based on credit scores and other parameters. This makes the process of borrowing money difficult and expensive. While banks have the advantage, the economy depends on banks providing the necessary funds for higher-cost items, such as houses and cars.

Blockchain technology allows anyone in the world to participate in a new type of lending ecosystem, which is part of Decentralized Finance (DeFi). To create a more accessible financial system, DeFi aims to put all financial applications on top of blockchain systems. Peer-to-peer money lending allows anyone to borrow and lend money in a simple, secure, and inexpensive way with no arbitrary restrictions. With a more competitive lending landscape, banks and firms will also be forced to offer better terms to their customers.

4. Trade finance

Engaging in international trade is very inconvenient due to a large number of international rules and regulations imposed on importers and exporters. Keeping track of goods and moving them through each stage still requires manual processes, which are filled with hand-written documentation and ledgers.

Blockchain allows trade finance participants to provide a higher level of transparency through a shared ledger that accurately tracks goods moving around the world. By simplifying and streamlining the complex world of trade finance, blockchain can save importers, exporters, and other businesses a significant amount of time and money.

5. Safer agreements with smart contracts

Contracts exist to protect individuals and businesses when they enter into agreements, but that protection comes at a high cost. Due to the complicated nature of contracts, the process of creating one requires a lot of manual work from legal experts and it takes both time and money.

Smart contracts can enable the automation of agreements through tamper-proof, deterministic code that is running on the blockchain. Money or assets can safely stay in escrow and are only released when certain conditions of the agreement are fulfilled. Smart contracts reduce the element of trust needed to reach an agreement, minimizing the risks of financial agreements and the odds of ending up in court.

6. Data integrity and security

Sharing data with trusted intermediaries and companies always carries a risk of the data being compromised. In addition to that, many financial institutions still use paper-based storage methods, which increases risk of loss and recordkeeping costs significantly.

Blockchain enables streamlined processes that automate data verification and reporting, digitize KYC/AML data and transaction history, and allow the real-time authentication of financial documents. This reduces operational risks, risk of fraud, and decreases the cost of handling data for financial institutions.

Conclusions

The potential benefits of the blockchain are more than just economic. They extend into political, humanitarian, social, and scientific domains. The technological capacity of the blockchain is already being harnessed by specific groups to address real-world problems.

Blockchain penetration could facilitate increased financial inclusion in emerging markets, as financial services on the blockchain gain critical mass. It could also drive the disintermediation of financial institutions, as new services and value exchanges are created directly on the blockchain.

There is already an entire industry built around blockchain and crypto assets and it is held by institutions dedicated to supervising all the digital crypto asset exchanges taking place throughout the world. The crypto asset industry is growing quickly and the economy is slowly shifting to adapt to these needs and crypto assets have a great potential in satisfying them. There are now many apps and programs that facilitate the use of crypto assets and bring them closer to the wider audience. An added benefit of crypto assets use is that it is open and decentralized, so trading can be done freely across borders at any time. The use of this technology will facilitate a financial revolution that will leave everyone more financially connected, empowered and enabled.

Sources: